Intel’s 2025 Massive Layoffs: Key Takeaways

- Intel’s 2025 massive layoffs will impact more than 20% of its global workforce, marking a significant step in CEO Lip-Bu Tan’s restructuring strategy.

- The layoffs aim to eliminate bureaucracy and restore Intel’s engineering-driven roots amid declining revenue and AI competition.

- Intel’s past missteps in AI and manufacturing left it trailing behind rivals like Nvidia and TSMC.

- The company plans to focus on core assets and divest non-essential units, such as the partial sale of Altera.

- CEO Tan believes the turnaround will be long but achievable, emphasizing talent reinvestment and manufacturing alignment.

Intel’s Boldest Restructuring Yet: Over 20% of Jobs Slashed in 2025 Layoffs

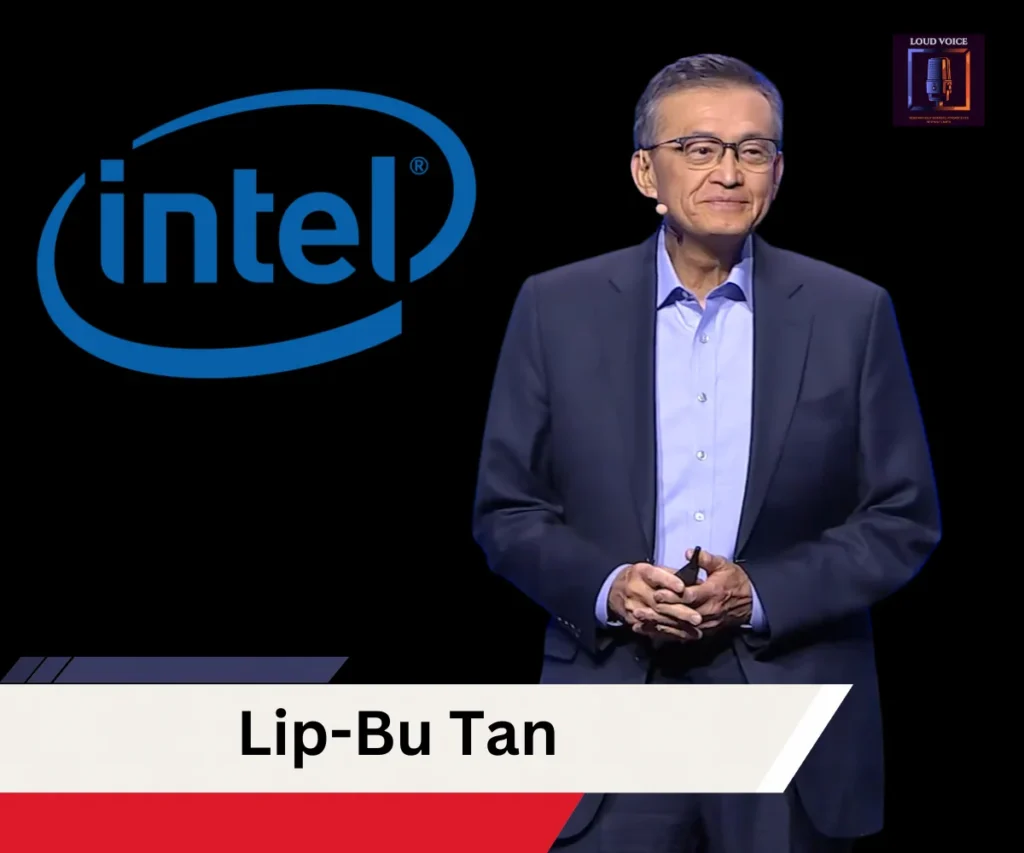

In a seismic move that could reshape the landscape of the global semiconductor industry, Intel Corporation is laying off more than 20% of its workforce in 2025, a restructuring initiative steered by newly appointed CEO Lip-Bu Tan. The company, once the unchallenged leader in silicon technology, is now in the midst of a desperate bid to restore relevance, efficiency, and innovation.

A Wake-Up Call From Within

Intel’s latest layoffs, impacting over 21,000 employees, aren’t just another belt-tightening maneuver. They’re a hard reset.

Sources familiar with the matter revealed that the cuts are aimed at dismantling layers of bureaucracy that have plagued Intel’s innovation engine for years. The move follows Tan’s appointment earlier this year—a decision that signaled a strategic shift after the unceremonious departure of former CEO Pat Gelsinger.

This isn’t Intel’s first rodeo. In 2024, the company already trimmed 15,000 jobs. However, this year’s round is deeper and more decisive, targeting middle management, underperforming verticals, and even select engineering divisions that no longer align with the company’s revamped mission.

“We lost our edge because we stopped listening to our engineers,” Tan remarked at the 2025 Intel Vision Conference. “This restructuring is about putting the right people back in the driver’s seat.”

How Intel Got Here: A Legacy Under Siege

For decades, Intel dominated the PC and data center chip markets. Its branding was ubiquitous, its processors omnipresent. But the company’s complacency in the face of the AI revolution opened the floodgates for challengers—chief among them, Nvidia.

Nvidia’s laser-sharp focus on GPU technology allowed it to surge ahead, particularly in AI computing. In contrast, Intel’s late response, compounded by delays in its foundry ambitions and manufacturing setbacks, left it scrambling for footing.

Add to that a complex and sluggish management structure, and the outcome was inevitable: a stock drop of over 43% in 2024, three consecutive years of revenue declines, and a slide in global influence.

Lip-Bu Tan’s Vision: Streamline, Specialize, and Spin Off

Lip-Bu Tan, a seasoned force from Silicon Valley and the former chief of Cadence Design Systems, arrived not merely with fresh ideas—but with surgical precision, ready to dissect the old guard and rebuild from the core.

His strategy is three-pronged:

- Trim the fat – Cut down bloated management and redundant operations.

- Sell non-core assets – A major example is Intel’s sale of a 51% stake in Altera to Silver Lake Management.

- Invest in talent and tech – Rebuild Intel’s engineering strength by attracting top-tier talent and revamping R&D investments.

Tan is also shelving some of the more ambitious but impractical expansions, such as Intel’s Ohio mega-facility. That site, once poised to be the largest chip manufacturing hub in the world, is now on indefinite hold.

The AI Opportunity That Slipped Away

Arguably, Intel’s biggest missed opportunity was the artificial intelligence boom.

While rivals like Nvidia and AMD surged ahead by offering chips optimized for AI workloads, Intel found itself playing catch-up. Gelsinger had attempted to retool the company into a foundry-first model, but the execution lagged, and the market moved faster.

Meanwhile, Taiwan Semiconductor Manufacturing Co. (TSMC) continued to cement its dominance. After TSMC CEO C. C. Wei confirmed that the company would concentrate on its own internal operations rather than working together, rumors of a strategic alliance between Intel and TSMC had subsided.

Reactions on Wall Street and Beyond

The day after the news was released, Intel’s stock increased 3.5% in premarket trading, despite the depressing extent of the layoffs. Though painful, analysts see the move as long overdue.

“It’s a tough pill, but it could be the right medicine,” said Morgan Stanley’s tech strategist Rachel Lin. “Investors want to see discipline, not desperation.”

Industry insiders, meanwhile, are split. Some applaud Tan’s boldness; others worry about the potential loss of institutional knowledge and the risk of over-correction.

What This Means for Employees—and the Industry

For employees, the impact is immediate. Thousands will lose their jobs across North America, Europe, and Asia. Intel has pledged severance support, career transition services, and potential rehiring paths under its talent renewal plan.

For the industry, the ripple effects are broader. As Intel reduces its global presence, rivals can increase hiring to take on the lost talent. The shakeup also signals to startups and mid-tier players that agility and innovation trump legacy and size.

Conclusion

Intel’s 2025 massive layoffs are more than a cost-cutting measure—they’re a bold statement of intent. With Lip-Bu Tan at the helm, the company is undergoing a foundational transformation that seeks to restore its engineering prowess, regain market trust, and pivot toward a more focused and future-ready business model. Whether this reboot will succeed remains to be seen. But one thing is clear: Intel is no longer content playing catch-up—it wants to lead again.