Introduction

The Pro-Rich Budget 2025 has sparked intense debate in the Lok Sabha, with the Opposition labeling it ‘pro-rich’ while the government defends its fiscal policies. As discussions unfold, key concerns such as economic inequality, taxation, and social sector spending come into focus. The budget is expected to have wide-ranging consequences, shaping the economic trajectory of the country for years to come. In this article, we break down the major arguments and implications of this year’s budget, examining both the criticisms and the defenses put forth by policymakers.

Why the Pro-Rich Budget 2025 Matters

The annual budget is more than just a financial statement—it is a policy blueprint that defines the government’s financial priorities for the upcoming year. It directly impacts multiple sectors, including agriculture, industry, healthcare, and education, affecting the livelihoods of millions. While supporters argue that the budget promotes economic growth and investment, critics claim that it prioritizes corporate interests over the needs of the common citizen, neglecting pressing social and economic issues such as poverty, inflation, and unemployment. The budget’s provisions will determine government spending allocations, tax policies, and economic regulations that will shape the country’s growth and development.

Key Opposition Criticisms

1. Neglecting Farmers and the Poor

- Congress MP Dharamvira Gandhi criticized the budget for failing to address farmers’ grievances, arguing that agricultural expenditure remains stagnant.

- CPI (ML) Liberation MP Sudama Prasad stated, “This is a pro-rich budget with nothing for the poor and youth.”

- Samajwadi Party’s Rajeev Rai urged the government to announce a debt waiver scheme to relieve farmer distress.

- Farmers have been struggling with rising input costs, fluctuating market prices, and inadequate government support. Critics argue that without increased financial aid and structural reforms, the agricultural sector will continue to suffer, further deepening rural distress.

2. Economic Favouritism Towards the Wealthy

- Trinamool Congress MP Abhishek Banerjee alleged the budget follows a “reverse Robin Hood” model—taking from the poor and benefiting billionaires.

- He pointed out that while corporate tax rates were reduced, subsidies on essential commodities were not increased.

- The budget includes provisions that significantly benefit large corporations, while social sector allocations remain largely unchanged.

- The Opposition claims that loan waivers for big businesses, tax cuts for corporates, and reduced wealth taxes are clear indications that the government is favoring the wealthy elite over the common people.

3. Lack of Measures Against Inflation and Unemployment

- Congress MP Pradyut Bordoloi emphasized that the budget fails to tackle rising inflation and unemployment.

- He suggested expanding food security programs and reducing GST on essential goods such as food, medicine, and medical insurance.

- Inflation has been eroding purchasing power, making essential commodities unaffordable for millions.

- The Opposition argues that the government should introduce direct subsidies, boost employment schemes, and implement wage support measures to support the working class.

Government’s Defense: A Balanced Approach?

Despite harsh criticism, the ruling BJP and its allies argue that the Pro-Rich Budget 2025 is designed to stimulate growth across all sectors:

- Taxpayer Benefits: BJP MP Rao Rajendra Singh highlighted that individual taxpayer received benefits worth ₹8.71 lakh crore in the past five years, compared to ₹4.53 lakh crore for corporations.

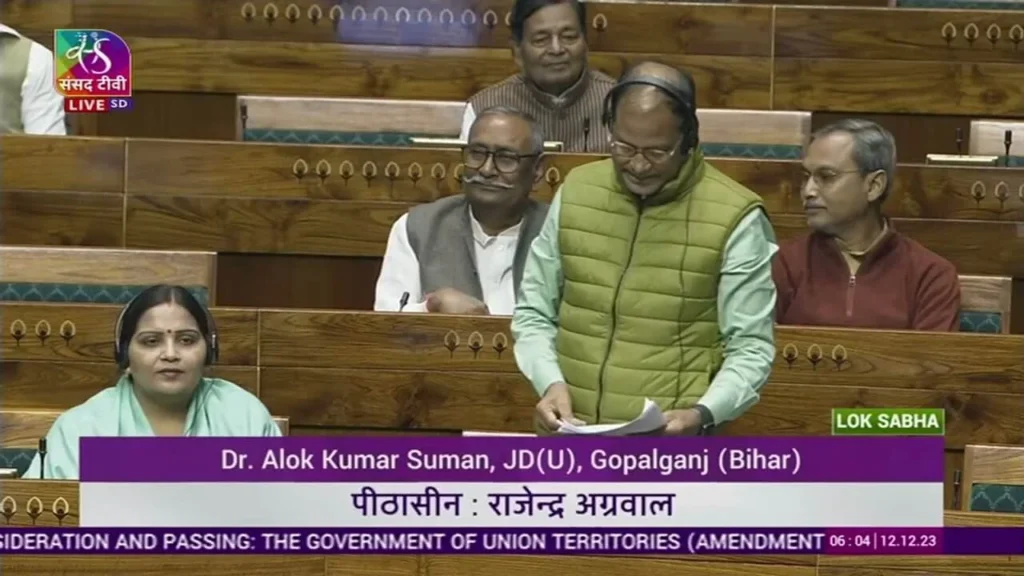

- Social Welfare: JD(U) MP Alok Kumar Suman and RLD MP Chandan Chauhan asserted that the budget would benefit all sections of society, countering claims of economic favoritism.

- Economic Growth Strategy: The government maintains that its policies are designed to increase job creation, attract foreign investment, and promote long-term financial stability.

- Investment in Infrastructure: The budget has significantly increased allocations for transportation, digital infrastructure, and renewable energy, with the goal of fostering sustainable development and economic expansion.

- Ease of Doing Business: The reduction of corporate taxes and streamlining of regulatory procedures are aimed at making India a more attractive destination for investors, which the government argues will create jobs and drive GDP growth.

Broader Implications of the Budget

While the political debate continues, the Pro-Rich Budget 2025’s impact on various sectors will play a crucial role in shaping India’s economic landscape:

- Small and Medium Enterprises (SMEs): Many SMEs feel left out, as tax benefits and subsidies seem to favor larger corporations. Without targeted relief, small businesses may struggle to compete.

- Healthcare & Education: Critics argue that budget allocations for public healthcare and education remain insufficient, which could have long-term implications for human capital development.

- Rural vs. Urban Divide: While urban areas benefit from infrastructure investments, rural communities may not receive adequate support, further widening economic disparities.

- Global Market Influence: With an emphasis on foreign investment and industrial expansion, the government is positioning India as a key player in the global economy. However, concerns remain about whether these policies will truly benefit the lower and middle classes.

Conclusion

The Pro-Rich Budget 2025 remains a divisive issue, with strong arguments from both supporters and critics. While the government insists on its commitment to economic growth and welfare, opposition leaders highlight gaps in agricultural support, inflation control, and equitable wealth distribution.

Ultimately, the success of this budget will be determined by how effectively its policies translate into tangible improvements in people’s lives. Will it create jobs, reduce poverty, and boost essential services? Or will it deepen economic inequalities?